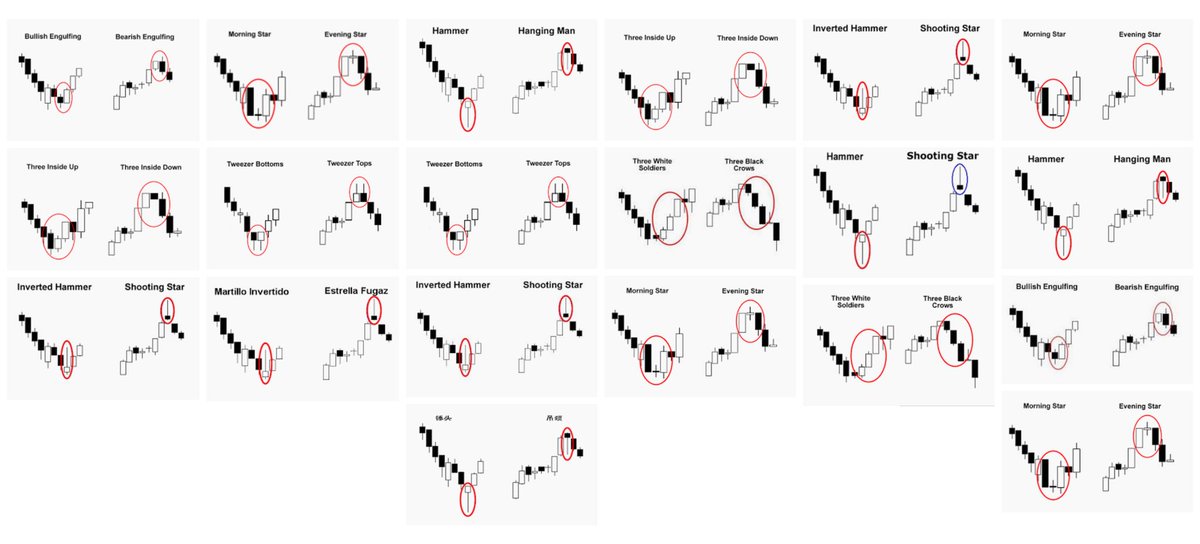

In fact, keeping an eye on 12 patterns will do the trick – and of these, 7 are relatively rare. Seen at a demand zone, it’s a solid indication buyers are keen on reversing the current price direction, raising the chances of a reversal from that level.įorex boasts around 32 distinct candlestick patterns.īut here’s the catch – you don’t need to master all of them to be successful. Many of these patterns can also act as confirmation signals when paired with other technical trading strategies.īullish Engulfing candlesticks are a clear signal bulls have outpowered the bears – a potential sign of a market reversal. This knowledge can sharpen your predictions about upcoming price shifts, helping you seize the advantage. The predictive power of these patterns not only deepens your grasp of the market but also clues you in on the behind-the-scenes thinking of traders. Learning the most common candlestick patterns can give you a significant edge.

These candlesticks serve as a window into the market mindset, which you can leverage to anticipate upcoming price movements. Remember, every pattern forms as traders buy and sell based on their future market predictions. Three White Soldiers And Three Black CrowsĬandlestick patterns – when one to three candlesticks line up in a specific sequence – can offer valuable insights into the underlying psychology of traders in the market.Bullish Engulfing And Bearish Engulfing.Hanging Man/Inverted Hammer Candlesticks.

0 kommentar(er)

0 kommentar(er)